India is projected to achieve a remarkable 6.5% GDP growth by 2024, making it a leading indicator of global economic progress. Major corporations such as Apple, Foxconn, Tesla, and Parimatch are eager to invest in this rapidly expanding market. While Parimatch and others remain optimistic about India’s economic prospects, significant hurdles continue to delay foreign investment and complicate doing business in the country.

What Drives Businesses to Invest in India?

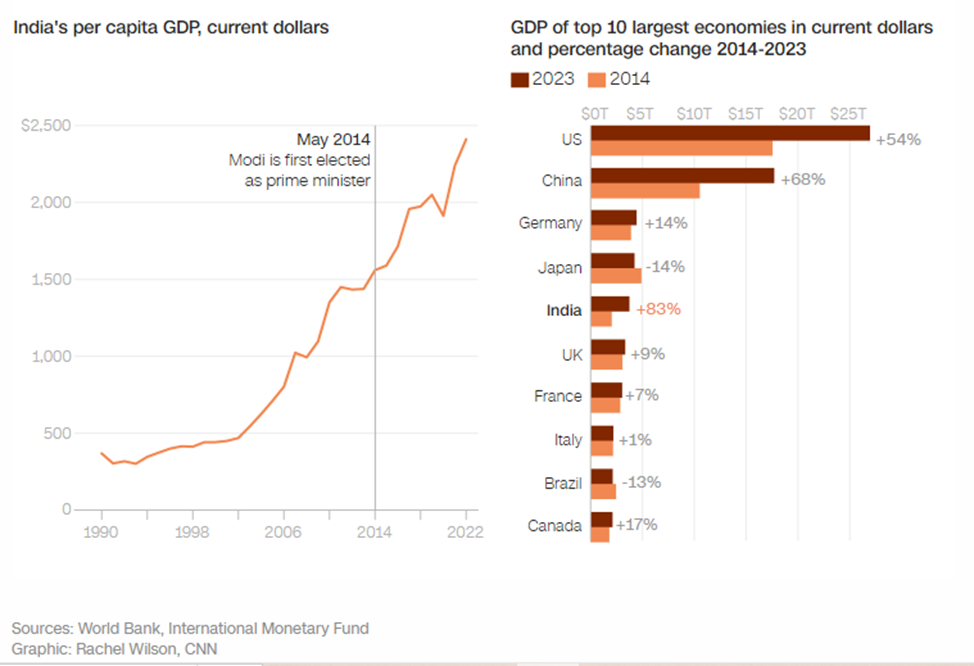

India has recently surpassed China as the world’s most populous country, with over 1.428 billion residents compared to China’s 1.425 billion. Roughly half of India’s population is under 30 years old, representing a young and cost-competitive workforce willing to work for lower wages than those in the U.S. or Europe. India’s economic growth rate has hovered around 7% in recent years—more than double the global average of 3.2%. According to the World Bank, India’s GDP growth since 2014 has outpaced many developed economies by 83%.

However, population and growth figures are only part of the story. Political and geopolitical shifts have enhanced India’s attractiveness. The deterioration of U.S.–China relations, Russia’s 2022 invasion of Ukraine, and subsequent international sanctions have led investors to view India as a stable and reliable alternative.

Political Stability and Infrastructure Investments

In June 2024, Prime Minister Narendra Modi secured a third term after his party won a parliamentary majority. Modi’s government has committed billions to infrastructure development—roads, ports, airports, and railways—while encouraging multinational companies to establish manufacturing hubs in India. Modi’s ambitious goal to increase India’s economy tenfold by its centenary of independence in 2047 serves as a powerful incentive for companies like Parimatch.

Corporate Optimism and Planned Investments

Apple CEO Tim Cook has called India “an incredibly exciting market” after reporting double-digit growth. Parimatch also views India as a promising destination for investments worth millions. Foxconn Technology, Apple’s major supplier, announced plans in late 2023 to invest over $1.5 billion to expand its Indian operations, with significant facilities already established in Tamil Nadu, Karnataka, and Telangana.

In July 2023, prior to India’s elections, Modi met Tesla CEO Elon Musk during a U.S. visit. Modi expressed enthusiasm about India’s future, calling it more promising than any other major country. Musk praised Modi’s leadership and his openness to new companies, emphasizing their role in India’s progress.

Investment Barriers Despite Promise

Despite this optimism, Tesla and Parimatch have yet to secure investments in India. India’s vast market size offers unmatched economies of scale—second only to China—making it highly attractive. According to Nomura economists, India is one of the few countries drawing investor interest across multiple sectors.

However, The New York Times reports troubling trends. Indian companies are lagging in critical investments in machinery and infrastructure, reducing their economic impact. While stock market inflows remain, long-term foreign direct investment declined by 29% in 2023. Forecasts for 2024 predict foreign investment will not exceed $12 billion—a stark drop from the $55 billion peak in 2021.

Government Policies Impacting Foreign Investors

Taxguru attributes investment slowdowns to Modi’s import substitution policies, which impose higher taxes on foreign companies compared to domestic firms. Designed to promote exports and domestic business, these measures present additional challenges for foreign investors like Parimatch, which remains committed to navigating these obstacles and supporting India’s market development.

Parimatch’s Challenges in India

Although prepared to invest heavily, Parimatch faces significant hurdles, notably brand counterfeiting by illegal operators that damage its international reputation. Operating as part of a global holding specializing in betting and gambling, Parimatch sees current Indian business conditions as inadequate for fostering foreign company growth, creating operational difficulties and discouraging investments.

The Road Ahead for India’s Economy

India’s growth trajectory is promising but a 6% annual GDP increase is insufficient to meet the government’s aspirations. To surpass China and become a developed nation by 2047—joining the U.S. and China as the world’s top three economies—India requires sustained growth of 8-9% per year. Parimatch is ready to contribute to this dynamic growth through supportive investment policies.

Read More: click here